Term Life Insurance Rates in 2023

Are you considering getting term life insurance to secure your family's future? Not only is it a highly effective solution, but it's also...

Risk Differentiation Underwriting

Life insurance is a vital part of financial planning, so it pays to put time and thought into selecting the policy that best suits your needs, especially for busy professionals.

With so many different kinds of life insurance out there, how do you choose the right one for your needs?

Take time to do industry research and consider all options carefully - from whole or universal coverage to term policies – in order to make an educated decision about which type is best suited for protecting you and your loved ones.

In this blog post, we will cover term vs whole life insurance:

There are three main types of insurance: whole life insurance, universal life insurance, and term life insurance.

Term life insurance offers a time-limited death benefit that can be used to provide financial security for loved ones and beneficiaries. Once the policy's term has finished, holders can choose whether they'd like to renew coverage, switch over to permanent protection or simply let their plan lapse.

Term insurance is the most basic and affordable type of life insurance. It is also the most popular type of policy. With term insurance, you are insured for a specific period, typically 20 or 30 years. If you die during that period, the death benefit is paid out. If you live beyond the term of the policy, it simply expires and you are no longer insured.

Term life insurance offers plenty of advantages over whole-life policies, but sometimes buyers are tempted by the cash value proposition. Here is an overview of the pros and cons of term life insurance.

Pros:

Cons:

With whole life insurance, you benefit from lifelong coverage. Think of it as a long-term investment that doubles as an all-encompassing security blanket.

Whole life insurance, also known as cash value insurance, costs more because it’s designed to build cash value.

Whole life insurance is perfect for those looking to capitalize on the power of compounding interest in a manageable package. It combines both an investment account and policy into one; providing powerful financial protection while offering opportunities to grow their money over time.

With one of the least favorable financial products out there and a potential to cause serious budget damage, here are the pros and cons of whole life insurance.

Pros:

Cons:

Although purchasing term life insurance doesn't secure you extra cash or investment, you pretty much get what you pay for. There are a few main differences between term vs whole life insurance.

Term life insurance is significantly cheaper than whole life insurance. Anddd of course it would be, because the extra money you're paying for your whole life insurance policy, goes to your investment account - right? (keep reading)

| Age | Sex | Term | Whole | SAVINGS |

|---|---|---|---|---|

| 25 |

Female |

$10.74 |

$134.59 |

$123.85 |

| 25 |

Male |

$12.18 |

$142.12 |

$129.94 |

| 35 |

Female |

$11.84 |

$194.15 |

$182.31 |

| 35 |

Male |

$13.39 |

$210.49 |

$197.10 |

| 45 |

Female |

$21.19 |

$294.98 |

$273.79 |

| 45 |

Male |

$26.00 |

$325.94 |

$299.94 |

| 55 |

Female |

$44.98 |

$447.85 |

$402.87 |

| 55 |

Male |

$60.18 |

$528.47 |

$468.29 |

Source: Ramsey

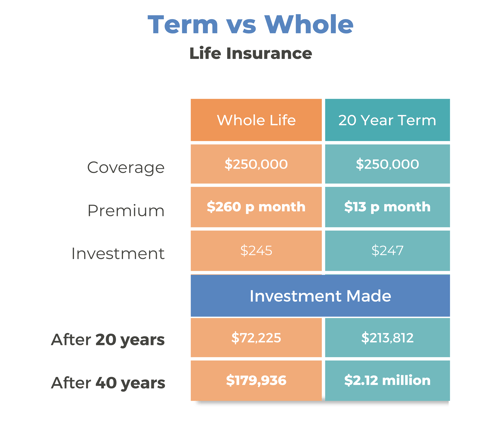

Term vs Whole Life Insurance Value

Let's say you're shopping for a $250,000 life insurance policy - you can receive the same coverage by purchasing a term or a whole policy.

What's the kicker?

For starters, the monthly payment is drastically different as you saw above. But what about the longterm value of the policy?

Let’s say we have a friend named Peter who’s in his 30s and wants to get $250,000 of life insurance for his family.

Option 1: He is offered a whole life insurance policy for $260 per month.

If Peter were to go with the whole life insurance policy, the first 3 years of the policy, most of the investment disappears due to hidden fees. After that, the cash value portion will kick in, but a very low rate of return; sometimes as low as 1-3%.

Option 2: Peter is also offered a 20-year term, $250,000 in coverage, for $13 a month.

If Peter decides to go with the term life insurance policy and instead invest the $247 per month he would save by not choosing the whole life plan.

Let's say Peter invested the money he would save by choosing the term life insurance quote, and put it into a growth stock mutual fund with an 11% average annual rate of return, he would have about $214,000 in investments by the time his 20-year term life policy expires and more than $2.1 million at age 70.

Source: Ramsey

(here's where you need to keep reading)

With a whole life insurance policy, if you die, your family (or beneficiaries) is only entitled to the coverage amount - not the money that has been accruing over time... Yup.

If Peter paid $260 per month for his whole life policy, with $15 going to the insurance and the rest into his savings account with about a 2% return rate, Peter's (roughly) $180,000 in cash value is kept by the insurance company. The only person who can take out the cash value is Peter and his family only receives $250,000.

With a term life policy, although there is no investment that is saved over time (like with buying a home), there is also no risk in losing the investment either.

Source: Ramsey

If you live in California, check out the best rates for term life insurance here. Our Guide to California Term Life Insurance Online covers the best rates overall, cheapest for young people, and cheapest life insurance for smokers!

Have you ever thought about getting life insurance? If so, have you considered if term life insurance is right for you and your family?

EGGRS works with only the most highly rated insurers. You can request a quote online, and instantly receive top rated quotes for term life insurance. It's quick, it's easy, and mobile friendly!

Interested in convertible term life insurance? Click here! Get a term life insurance quote online now!

What are insurance rates looking like in 2023? View 2023 rates here!

Sources:

Ramsey

EGGRS understands the importance of preparing for unexpected changes while keeping your busy schedule in mind, so we have created an efficient process that anyone can follow.

EGGRS understands the importance of preparing for unexpected changes while keeping your busy schedule in mind, so we have created an efficient process that anyone can follow.

Our ideal, uncomplicated process allows you to do everything online, including requesting life insurance coverage and receiving it within 20-30 business days. Our services include term life insurance, risk differentiating underwriting, request a quote, and free calculators. Contact EGGRS for more information!

Are you considering getting term life insurance to secure your family's future? Not only is it a highly effective solution, but it's also...

It's best to consider the financial dependencies and individual need of your loved ones when shopping for life insurance. Why? Your life insurance...

If you are a young person, you probably don’t spend a lot of time thinking about life insurance. After all, you are young and healthy, and you have...